INDUSTRY INSIGHTS

Industry Resources & Downloads

Delivering Expert Analysis

On Supply Chain & Logistics Innovations

The Future of High-Performing Supply Chains in 2025 and Beyond

The organizations stepping forward as supply chain leaders in 2025 are not defined by the size of their networks or the reach of their facilities. They stand out because they are willing to rethink what a modern supply chain should accomplish. These companies treat supply chain work as a strategic engine that shapes customer experience, supports innovation and strengthens business resilience.

Trade Show Playbook: How to Win the Field to Fulfillment Game

Trade shows are high-impact moments where operational precision meets brand opportunity. This article explores how leading manufacturers and brands are leveraging agile logistics to not just show up—but stand out. Walk away with real-world strategies for reducing risk, accelerating setup, and converting trade show buzz into business momentum.

Winning Supply Chain Strategy: Powerful Lessons From the Game

Success in supply chain management, like success on the field, requires strategy, adaptability, and execution. A well-structured supply chain doesn’t happen by accident—it’s built with precision, agility, and a commitment to continuous improvement. Whether forecasting demand, optimizing logistics, or enhancing efficiency, the right supply chain strategy can turn operational challenges into competitive advantages.

From Warehouse to Stage: The Supply Chain Mastery Behind Major Events

From major corporate conventions to high-energy music festivals, successful events rely on more than just a great lineup—they depend on precise event logistics. Behind every seamless production, a dedicated logistics team is managing warehousing, transportation, and just-in-time deliveries to ensure everything arrives exactly when and where it’s needed.

With tight delivery windows, high-volume coordination, and last-minute changes, event logistics require expertise, adaptability, and real-time problem-solving

Which Warehouse Model Fits Your Business: Managed vs Leased

Choosing the right warehousing solution is a decision that shapes your supply chain efficiency, operational flexibility, and cost management. We understand the complexities of this decision and offer managed warehouse space and commercial lease options to meet diverse business needs. Here’s an in-depth look at how these options compare and how RGL can help you choose the best solution.

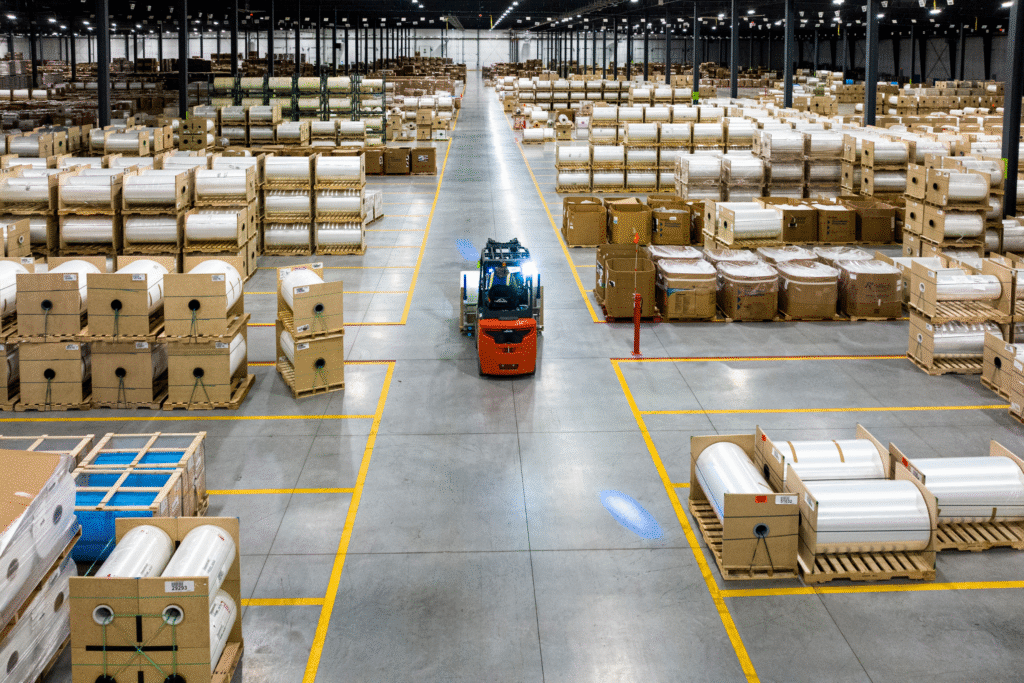

Midwest Distribution: Connecting You to Nationwide Markets

The logistics landscape is always evolving, and the decisions you make today can have lasting impacts on your business’s success. When it comes to choosing the right location for your distribution center, the Midwest stands out as a region that offers more than just geographical convenience. Let’s explore why so many businesses are choosing the Midwest as their strategic distribution hub

RGL’s 400% Growth in Refrigerated Co-Packing

Are you a supply chain leader in the manufacturing industry, dealing with the complexities of refrigerated co-packing and storage? Imagine a solution that not only meets your stringent temperature control needs but also scales rapidly to accommodate growing market demands. Our latest case study unveils how RGL Logistics accomplished an astounding 400% growth by swiftly […]

Infographic: Secure Your Supply Chain with Confidence

In today’s fast-paced and ever-evolving logistics landscape, protecting your supply chain from risks is more crucial than ever. Our comprehensive guide, “5 Steps to Mitigate Risk to Your Supply Chain,” offers essential strategies to safeguard your operations against potential threats.

Case Study: Achieving 100% OTIF – A Benchmark in Warehousing Excellence

Discover how RGL Logistics achieved an industry-leading 100% On-Time In-Full (OTIF) delivery and 100% quality assurance. Our comprehensive case study reveals the innovative strategies and core values that drive our success in managing over 2 million square feet of warehouse space and 15,000 truckloads annually.

- 1401 State St, Green Bay, WI 54304

- (920) 432-8632

- info@rgllogistics.com